Selling Visas and Citizenship: Policy Questions from the Global Boom in Investor Immigration

Over the past decade, the number of countries with immigrant investor programs has increased dramatically. Although governments have long extended residence permits or citizenship to wealthy individuals willing to invest large amounts in their economies, the forces of globalization and rapidly increasing interest among prospective immigrant investors are challenging policymakers to step up to meet this demand. About half of Member States in the European Union now have dedicated immigrant investor routes, while Malta and countries in the Caribbean have developed their own "citizenship-by-investment" programs, sparking public debate.

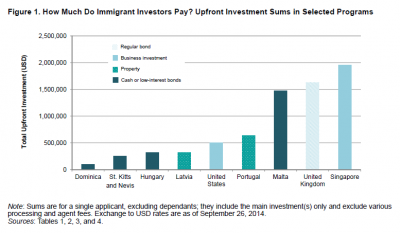

In theory, the benefits of immigrant investor programs for both newcomers and destination countries are straightforward. For potential investors, these initiatives make doing business abroad attractive by offering a faster or easier route to resettlement, insurance against political or economic upheaval at home, or access to visa-free travel, among other things. In exchange, destination countries enjoy the perks of new investment, including revenues and job creation. In practice, however, policymakers have been disappointed to find the economic impacts of immigrant investment are often modest at best, and designing a program to control where and how money is invested, thereby maximizing economic benefits, can be a challenge.

This report offers an overview of immigrant investor programs around the world, ranging from the United States, Canada, Australia, and the United Kingdom to Bulgaria, Greece, Latvia, Portugal, Spain, and St. Kitts and Nevis.

It examines several of the approaches policymakers have taken to encourage immigrant investment while balancing the objectives of economic benefit, public opinion, and program integrity. Finally, the report concludes with an outlook on the future of investor programs. Even as new countries take a shot at developing their own initiatives, more experienced players are reviewing or scrapping their programs altogether due to insufficient economic benefits, and these outcomes will likely have implications for future program design.

I. Introduction

II. How Do Immigrant Investor Programs Work?

A. Who Applied for Investor Programs and Why?

B. Types of Immigrant Investor Programs

III. Determining the Investment Type

A. Programs Based on Private-Sector Transaction

B. Programs Based on Investor-Government Transactions

IV. Immigrants or Casual Visitors? Residency Requirements

V. Ensuring Integrity

VI. What Next? The Future of Investor Programs