You are here

African Countries Relax Short-Term Visa Policies for Chinese in Sign of Increased Openness to China

Chinese tourists in Egpyt. (Photo: Bob Gaffney)

China’s rapid economic growth since the end of the 1970s has dramatically expanded its geopolitical and economic footprint across the world. The country’s unprecedented socioeconomic advances have also enabled high levels of emigration: Since 1978, approximately 10 million Chinese have moved abroad, and, while estimates vary widely, 10 to 20 percent of them have made their home in Africa.

Over the same period, increased domestic demand for natural resources and official policies aimed at strengthening overseas investment—including the “Go Out” policy that China initiated in 1999 and the Belt and Road initiative launched in 2013—have led to rising Chinese trade and investment across the African continent. According to the Beijing-based consultancy Development Reimagined, 72 percent of African countries participate in the Belt and Road initiative, a development strategy that involves China underwriting hundreds of billions of dollars of infrastructure investment in countries along the old Silk Road.

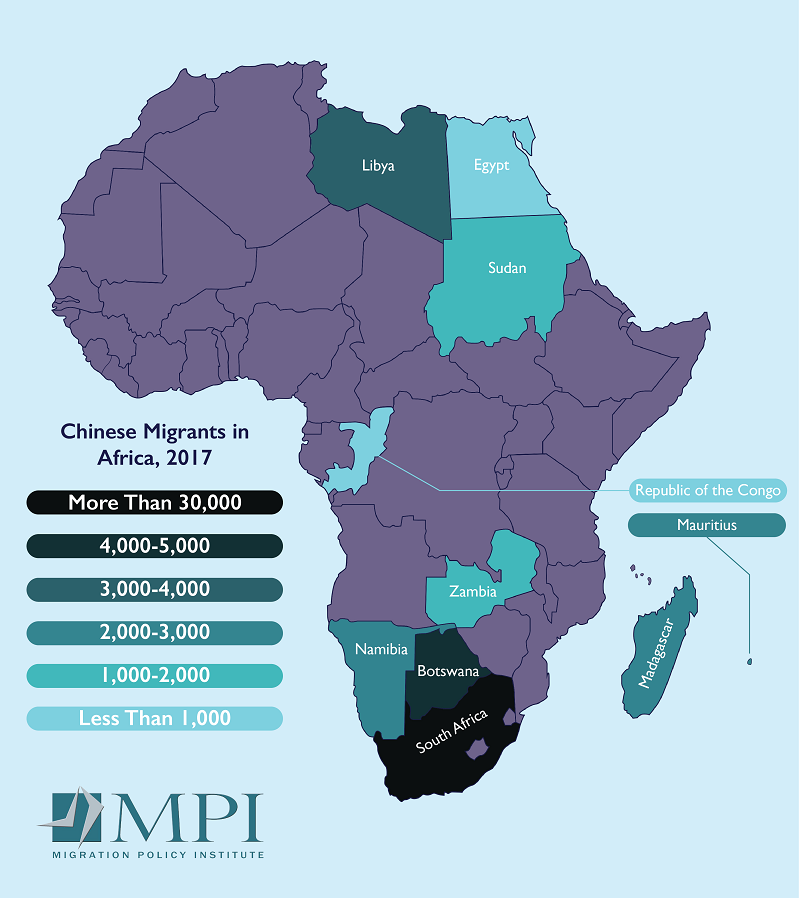

With China representing Africa’s largest trading partner since 2009, the emergence of an intensifying and diverse set of Sino-African exchanges has unsurprisingly been accompanied by increased flows of people in both directions. The estimated 1 million to 2 million Chinese in Africa are diverse in their provincial origin, their length of stay, socioeconomic class, occupation, and age. Some are diplomats or aid workers, others are laborers working on infrastructure projects, while others are private entrepreneurs, multinational executives, or tourists. Chinese migrants have settled in communities across the continent, with South Africa, Angola, Madagascar, Nigeria, and Mauritius among those hosting particularly large Chinese communities.

Figure 1. Chinese Migrant Population in Africa, mid-2017

Note: Data are not available for all countries in Africa.

Source: United Nations Department of Economic and Social Affairs, “Trends in International Migrant Stock—Migrants by Destination and Origin,” accessed July 22, 2019, available online.

As the number of Chinese nationals in Africa has increased, some African governments have adjusted their visa policies toward China, for example offering visa-free travel for relatively brief stays or visas upon arrival. This article examines adjustments to African states’ short-term visa entry requirements for Chinese since 2016 analyzing the reasons behind the changes and the possible impacts, while providing perspectives on the opportunities and risks that come with different visa policies.

Liberalization of Visa Regimes

Data on visa openness globally highlight that the world has become increasingly open toward Chinese in recent years. According to the Henley Passport Index, which analyzes data from the International Air Transport Association on the countries people can access with or without a visa on arrival, the Chinese passport rose in the rankings from 94th in 2015 to 67th in 2019 (in a tie with Lesotho) in terms of the number of countries that its holders can access without a visa or with a visa on arrival. While Chinese still generally face more restrictions than nationals from most high-income countries—Japan, Australia, and several European countries currently make up the Index’s top ten—they are finding access progressively easier to more countries.

The global trend toward relaxing visa restrictions on Chinese visitors owes to a number of factors, including facilitation of Chinese business travel and tourism. According to management consultant firm McKinsey & Company, Chinese outbound tourists spend the most per trip among global travelers and took 131 million trips in 2017, compared with 117 million in 2015. Moody’s noted in 2018 that the increase in direct flights and the relaxation of visa rules would encourage more Chinese visitors to Africa.

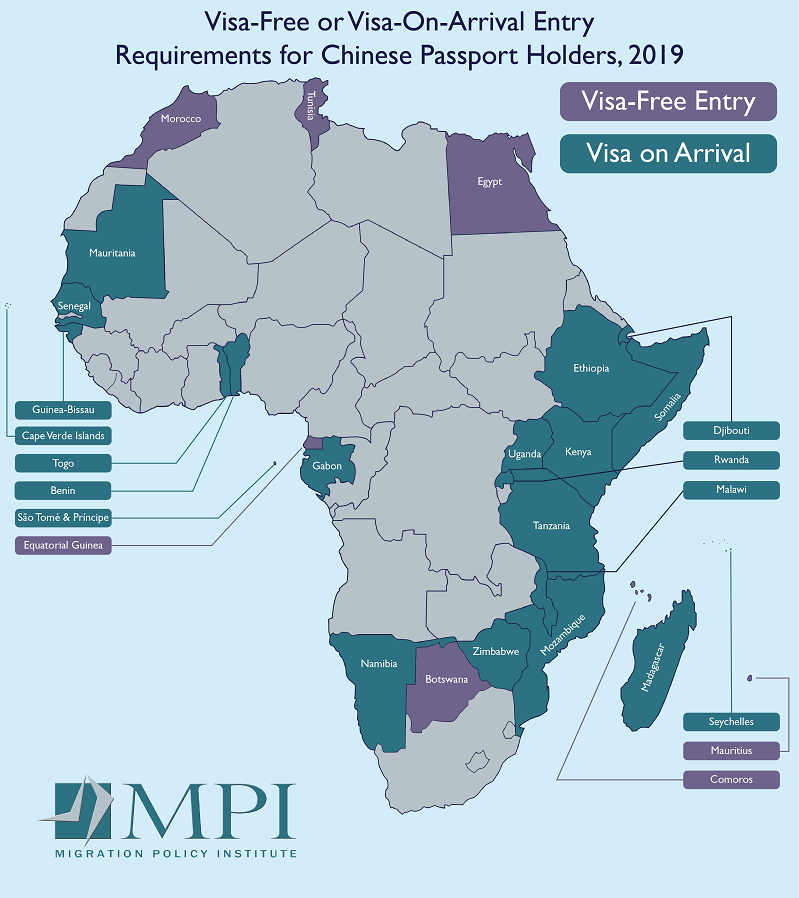

Chinese nationals can now arrive in 27 African countries without previously applying for a visa. The majority of these countries are concentrated along the continent’s east coast, from Somalia down to Mozambique, as well as, to a lesser degree, the northwest coast from Morocco down to Guinea-Bissau. This, coupled with recent changes to visa requirements for Chinese nationals in countries as diverse as Zimbabwe, Kenya, and Tunisia, underlines the general trend towards relaxation of entry requirements for Chinese nationals across the continent. Beyond the countries that have removed predeparture visa requirements, several others, including Angola and South Africa—both of which have particularly significant relationships with China and existing Chinese migrant populations—have also made it easier for Chinese business travelers to obtain longer-term multiple-entry visas.

Figure 2. African Countries that Allow Visa-Free or Visa-on-Arrival Entry to Chinese Passport Holders, 2019

Source: Henley and Partners, “Compare My Passport – China,” updated March 26, 2019, available online.

While acquiring data on African countries’ issuance of permanent residence or long-term visas, for employment or other purposes, was not possible, the trends for short-duration visas examined here demonstrate a willingness across the continent to facilitate travel and short-term business exchanges for Chinese nationals. Interestingly, high levels of Chinese investment did not always correlate with a more liberal temporary visa regime; instead, this trend suggests an openness toward cultural and tourist exchanges.

Highly Publicized Recent Visa-Relaxation Announcements

In September 2018, China was one of the big winners of South Africa’s newly relaxed rules on short-duration visas. Already one of the biggest destinations for Chinese investment (around 5 percent of Chinese investment in Africa) and migration (a 450,000-strong diaspora), it was announced that Chinese business travelers would be granted ten-year multiple-entry “BRICS visas” without having to apply in person. The announcement of the changes, which also extended to Brazilian, Russian, and Indian business travelers but did not relax restrictions for other African nationals, underlined the commercial motive behind the change, as part of South African President Cyril Ramaphosa’s new economic stimulus and recovery plan. “Easing movement in this manner will help in attracting larger numbers of tourists, businesspeople, and families,” the visa liberalization announcement said.

In the same year, fellow southern African nations Zimbabwe and Botswana decided to grant visas on arrival to Chinese nationals, with the latter relaxing restrictions on a range of other nationalities. Again, the related media coverage articulated the moves in terms of their potential to boost Chinese tourism, with Zimbabwe’s announcement explicitly stating that Chinese nationals still must apply in advance for visas covering other activities, including temporary employment.

At the opposite end of the continent, Tunisia began to offer visa-free entry to Chinese visitors in 2017, after seeing the number of Chinese tourists rise to around 20,000 from 12,000 in 2016. Again, media coverage emphasized the importance of tourism in the decision, with some forecasting the number of Chinese visiting the country to increase to 50,000 by 2020, having already jumped 93.5 percent from 2015-16 (the year before the change), with the 90-day visa waiver made conditional on travelers having a return flight and valid hotel reservation. Nearby Morocco had a similar experience, seeing Chinese arrivals increase by 378 percent in the six months after exempting Chinese nationals from entry visas in 2016.

In early 2018, Angola and China concluded an agreement to provide preferential visit visas to each other’s nationalities. Angola, rich in natural resources, was the fifth largest recipient of Chinese investment in Africa in 2017. Reports emphasized that the change would facilitate business visits, saying that it would cut processing times and ensure that business travelers would now only have to apply for visas at most once a year. It was also reported that Chinese and Angolan nationals would be allowed to undertake limited work activities in each other’s countries with a visit visa, which departs from the arrangements highlighted in the other cases.

Finally, in December 2018, Ethiopian Airlines established a visa center, which, according to the airline’s CEO, “will facilitate easier air travel for Chinese experts and businesspeople” by allowing Chinese visitors to obtain visas upon arrival at Addis Ababa’s international airport, instead of at an Ethiopian consulate.

Box 1. Short-Term Visa Requirement Relaxations for Chinese Nationals, 2016-18

2016: Morocco (visa-free for 90 days)

2017: Tunisia (visa-free for 90 days), Mauritius (extension from 30 days visa-free to 60 days)

2018: Angola (reciprocal 12-month multiple-entry visas), Botswana (visa on arrival), Ethiopia (e-visas), South Africa (BRICS business visa), Rwanda (visa-free), Zimbabwe (visa on arrival)

While these recent decisions indicate that Chinese nationals are facing fewer restrictions on their travel to the continent, the 2018 African Visa Openness Report also found that African countries are becoming more open to each other’s nationals, with 43 countries improving or maintaining their score. Free movement throughout Africa is expected to be further supported by the implementation of the Free Movement of Persons Protocol, adopted across the continent in 2018. At the same time, the world’s increasing openness to Chinese nationals is also evident in Asia, where Malaysia, Indonesia, Qatar, United Arab Emirates, and Armenia have relaxed entry requirements in recent years.

Implications of Visa Liberalization for Africa

Visa systems are the primary way in which states regulate the entry and stay of non-nationals. They generally comprise visas granted offshore before the bearer travels, a visa on arrival, or authority to remain granted to a person who has already entered the issuing country. Countries can also grant visa waivers or exemptions to certain categories of people.

Some African countries have liberalized requirements for Chinese only, while others, such as Rwanda, decided to offer visas on arrival to all nationals. Moreover, visa changes may represent broader policy changes, as in South Africa; a unilateral measure taken by the destination country without quid pro quo, as in Tunisia; or as part of a reciprocal agreement, per the Angolan case. A well-designed and well-managed visa system supports a state’s capacity to foster international business and trade linkages, develop its tourism industry, attract foreign investment, foster international labor mobility, and benefit from international cooperation.

To determine visa requirements for Chinese and other nationals, African governments may consider several factors, including perceived security risks posed by Chinese nationals, diplomatic relations with China, and the socioeconomic impacts of inflows resulting from new arrangements on labor markets, tourism, trade, and investment.

Are Visa Regulations Driven by High Levels of Chinese Investment?

The exact motivations behind this trend are unclear. Moves toward visa waiver and visa-on-arrival arrangements for Chinese nationals may be purely intended to facilitate short stays. Some of the country visa-liberalization policies (Tunisia, Morocco, and Zimbabwe) were articulated in terms of benefits to the tourism sectors. The South African and Angolan cases, meanwhile, emphasized the importance of facilitating business visits, which likely reflects the two countries’ status as major Chinese investment destinations (South Africa was the top recipient of Chinese investment in Africa in 2017).

Despite the fact that the vast majority of Chinese migrants in African countries are labor migrants, review of African countries’ visa policies has not turned up any instances in which decisions were taken to directly facilitate labor migration. However, it is clear that the presence of Chinese companies facilitating construction, infrastructure, and other projects will continue to attract Chinese labor migrants to different African countries, regardless of whether further visa liberalization occurs.

Instead, there is an indirect relation between relaxed visa requirements and improved relations with China: increased investment may be accompanied by migration, greater links with China, more direct flights, regular diplomatic exchanges, and increased tourism. However, there does not appear to be a clear correlation between ease of entry for Chinese nationals and the levels of Chinese investment or Chinese migration.

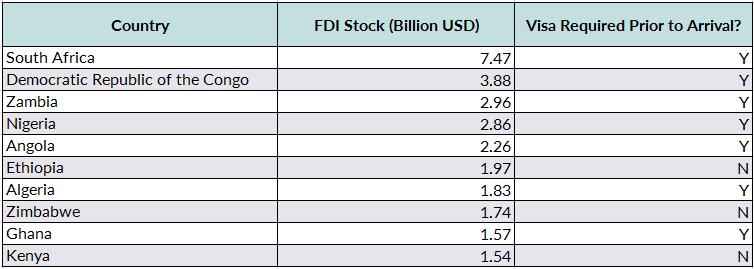

The countries that do allow visa-free entry or visas on arrival are countries in which China is known to have made important investments (oil-rich Gabon and Equatorial Guinea, for instance, are exceptions to the general inaccessibility of the Central African subregion). But Chinese nationals still need to apply for visas prior to entering seven of their top ten African investment destinations (see Table 1). There are also still entry requirements in place in countries known for hosting large Chinese migrant populations, such as Zambia, Algeria, and Senegal (one of the few West African countries offering visa-free access to EU nationals), among others.

Table 1. Top Ten Chinese Investment Destination Countries and FDI Stock in Africa and Visa Requirements for Chinese Nationals, 2017

Note: According to the Organization for Economic Cooperation and Development (OECD), foreign direct investment (FDI) stock is the value of foreign investors’ equity and net loans to enterprises resident in the reporting economy. FDI stock is used here as a measure of Chinese investment in African countries.

Source: Johns Hopkins University School of Advanced International Studies (SAIS) China-Africa Research Initiative, “Chinese FDI Stock in African Countries,” updated February 28, 2019, available online.

Conclusions regarding visa liberalization should therefore be drawn with caution. Allowing greater ease of entry at the least shows that more African governments are less concerned about the risks of Chinese nationals entering for nefarious purposes or to overstay their visas; or that the expected boost in tourism revenue and benefits from increased business visits are deemed to outweigh any abuse. Indeed, visas on arrival can also come with conditions, such as Egypt’s arrangement requiring Chinese nationals to arrive with USD 2,000 in cash, or Tunisia’s which requires proof of hotel reservation.

At the same time, the changes do not necessarily support the notion that Chinese migration is being increasingly welcomed or facilitated: visa-free entry and visa waivers are generally intended for tourists, visiting relatives, and business travelers. Many countries limit such arrangements to tourism only (entry stamps will often read “employment not permitted”). Employment, investment, and other longer-term stays generally require other categories of visa, which must be applied for in advance, while scope for changes in status following visa-free arrival varies from country to country.

Opportunities and Risks in Facilitating Chinese Arrivals

Relaxing visa restrictions on Chinese nationals carries a host of potential advantages for African countries. Many are embracing intensified economic and cultural relations with China, with more than 10,000 Chinese-owned firms now operating across the continent and Confucius Institutes (Chinese government-funded language and cultural promotion centers) jumping from zero to 48 from 2004-18. In the six months after Morocco exempted Chinese tourists from visa requirements in 2016, Chinese arrivals more than tripled, with Tunisia and Mauritius also seeing significant increases in arrivals (and presumably revenues). The China Outbound Tourism Research Institute found that 45 percent of Chinese tourists consider ease of visa procedures as part of their choice of destination. Furthermore, visa exemptions can facilitate business exchanges, visits by the families of Chinese migrants, international cooperation, and cultural exchanges. However, the benefits are difficult to quantify beyond the time and financial savings for regular visitors who no longer must reapply for visas.

Nevertheless, these policies are not without challenges. While China has brought hundreds of billions of dollars of investment and aid to the continent (estimated at USD 60 billion in 2018 alone), the intensifying relationship has also been marked by organized crime, from wildlife trafficking to illicit resource extraction. Given that many immigration authorities across the continent do not obtain advanced passenger information or access international warning lists, visa waiver and visa-on-arrival arrangements remove a key tool for vetting travelers and regulating entry.

In addition—and perhaps more applicable to African contexts—removing entry requirements may also increase the risk of irregular migration stemming from overstaying the validity of visa-free or a visa-on-arrival entry (often 30 to 90 days). Estimates on irregular migration are inherently difficult to come by, but literature on Chinese communities in Africa points to frequent overstay. One estimation from Zambia in 2015 suggests that one-third of Chinese nationals will overstay their visa.

Some consider visa-free or visa-on-arrival entry, particularly when switching between different types of visas is permitted, a pull factor for migrants to seek or engage in employment or business activities irregularly—both of which generally require specific authorization. This challenge may be particularly pertinent to certain African countries, as the migration of Chinese nationals to work on Chinese investment projects across the continent is well documented. Requiring Chinese to apply for short-stay visas still allows the possibility of overstay and irregular migration but arguably constitutes a minor barrier to engaging in such behaviors, while allowing authorities to vet travelers and collect information prior to arrival or enforce additional controls, such as making a resident of the country responsible for the visitor’s stay.

Sino-African Ties Poised to Benefit from Liberalized Visa Regimes

There are now 27 African countries in which Chinese nationals can arrive without applying for a visa in advance, and at least nine countries relaxed visa restrictions since 2016 (see Figure 2). These changes have occurred against the backdrop of a move to liberalize visa restrictions on Chinese nationals globally—perhaps reflecting a change in the perceived level of risk of Chinese travelers and increase in the country’s political and economic power. At the same time, in Africa, there is a broader move underway towards free movement within the continent.

While more research is required into the extent to which restrictions on Chinese nationals obtaining employment and residency permits from immigration authorities have eased, more open visa regimes across the continent have the potential to facilitate different forms of mobility by reducing the time and financial costs of travel. This can help foster the people exchanges that are implicit in the burgeoning Sino-African relationships, while allowing African countries to tap into Chinese outbound tourism growth, or making it easier for Chinese migrants to have their relatives visit, as well as reducing the scope for migrant smuggling.

On the other hand, governments need to be aware of the challenges that can come with increased inflows and their impacts—perceived or real—on their communities. Enforcing visa restrictions allows countries to vet travelers prior to arrival, allowing greater scope to collect key traveler information and to apply additional restrictions to reduce the risks identify.

Sources

African Union. 2018. African Countries Are Becoming More Open to Each Other; 2018 Africa Visa Openness Report Shows. Press release, November 28, 2018. Available online.

Arka News Agency. 2019. Armenia, China Scrap Visas. Arka News Agency, May 27, 2019. Available online.

Bavier, Joe. 2018. Africa Missing out on Boom in Chinese Tourism. Reuters, November 23, 2018. Available online.

Berry Applemen and Leiden. 2018. Angola/China—Agreement Reached on Mutually Preferential Visa Regime. The Forum for Expatriate Management, January 17, 2018. Available online.

CGTN. 2019. Folk Hospitality Draws Growing Number of Chinese Tourists to Tunisia. CGTN, March 28, 2019. Available online.

Chen, Wenjie. 2015. Chinese Investment in Africa Is More Diverse and Welcome Than You Think. Quartz, August 27, 2015. Available online.

Chutel, Lynsey. 2018. South Africa Is Easing Visa Restrictions for Chinese and Indian Visitors, but Not Africans. Quartz, September 26, 2018. Available online.

Dahir, Abdi Latif. 2018. Ethiopian Airlines Will Start Helping Chinese Travelers Move Easier Across Africa. Quartz, December 4, 2018. Available online.

Delex, Niyongabo. 2018. Rwandan Government Grants Visa-Free Entry to Six Countries. Regionweek, October 26, 2018. Available online.

Department of Home Affairs of the Republic of South Africa. 2018. Statement by the Minister of Home Affairs, Mr. Malusi Gigaba MP, at the Media Briefing on Visa-Related Reforms in Pretoria. Statement, September 25, 2018. Available online.

Dews, Fred. 2014. Eight Facts about China’s Investments in Africa. Brookings Institution blog post, May 20, 2014. Available online.

Ditcher, Alex, Guang Chen, Steve Saxon, Jackey Yu, and Peimin Suo. 2018. Chinese Tourists: Dispelling the Myths. New York: McKinsey and Company, 2018. Available online.

Economist, The. 2018. Surging Numbers of Chinese People Going Abroad Should be Welcomed. The Economist, May 17, 2018. Available online.

Forward Keys. 2017. Chinese Tourism Is Overflowing. Forward Keys, November 2, 2017. Available online.

非洲各国最新签证政策 | 一生总要去一次非洲,可是签证你都了解吗?. 2017. Sohu, October 26, 2017. Available online.

Henley and Partners. 2019. Compare My Passport – China. Updated March 26, 2019. Available online.

---. N.d. Henley Passport Index (multiple years). Accessed May 15, 2019. Available online.

Irungu, Geoffrey. 2018. Kenya Set for More China Tourists, Says Moody's. Daily Nation, July 5, 2018. Available online.

Jayaram, Kartik, Omid Kassrir, and Irene Yuan Sun. 2017. The Closest Look Yet at Chinese Economic Engagement in Africa. New York: McKinsey and Company, 2017. Available online.

Johns Hopkins University School of Advanced International Studies (SAIS) China-Africa Research Initiative. 2019. Chinese FDI Stock in African Countries. Updated February 28, 2019. Available online.

Munyoro, Fidelis. 2018. Zim Relaxes Visa Terms for Chinese Tourists. The Herald, June 13, 2018. Available online.

Park, Yoon Jung. 2009. Chinese Migration in Africa. Occasional Paper No. 24, China in Africa Project, South African Institute of International Affairs, Johannesburg, January 2009.

Postel, Hannah. 2017. Moving beyond “China in Africa:” Insights from Zambian Immigration Data. Journal of Current Chinese Affairs 46 (2): 155-74.

Presidency of the Republic of South Africa. 2018. Statement by President Cyril Ramaphosa on Economic Stimulus and Recovery Plan. Statement, September 21, 2018. Available online.

Sow, Mariama. 2018. Figures of the Week: Chinese Investment in Africa. Brookings Institution blog post, September 6, 2018. Available online.

Sullivan, Jonathan and Jing Cheng. 2018. Contextualizing Chinese Migration to Africa. Journal of Asian and African Studies 53 (8): 1173-87.

United Nations Department of Economic and Social Affairs. 2017. Trends in International Migrant Stock—Migrants by Destination and Origin. Accessed July 22, 2019. Available online.

Vaughan, Jessica M. and Preston Huennekens. 2018. Analyzing the New Visa Overstay Report. Washington, DC: Center for Immigration Studies. Available online.

Wang, Huiyao. 2014. Recent Trends in Migration between China and Other Developing Countries. Presentation at the International Organization for Migration, South-South Migration: Partnering Strategically for Development conference, Geneva, March 24-25, 2014. Available online.

Xing, Xiaojing. 2019. Botswana Eyeing Chinese Foreign Investment: Ambassador. Global Times, May 12, 2019. Available online.

Xinhua. 2017. China Remains Africa’s Top Trading Partner. Xinhua, April 16, 2017. Available online.

---. 2018. Spotlight: Chinese Tourists’ Fever for Morocco Heats up after Visa-Free Policy. Xinhua, August 11, 2018. Available online.

Zainal, Fatimah. 2019. Govt Plans to Relax Entry Requirements for Chinese Tourists. The Star, May 27, 2019. Available online.

Zhang, Rui. 2017. Tunisia Announces Visa Exemption for Chinese Tourists. CCTV, February 2, 2017. Available online.

Zhang, Xinyue. 2019. More Chinese Travel to Neighboring Asian Countries. CGTN, May 13, 2019. Available online.