You are here

The Uneven Path Toward Cheaper Digital Remittances

A mobile money agent in Uganda. (Photo: Daivi Rodima-Taylor)

Financial remittances that migrants and others send to families and friends abroad are an important source of economic support for many households in the Global South. Yet despite frequently surpassing official development assistance and foreign direct investment in remittance-receiving countries, these funds can be rather costly to send, especially for low-income migrants who are transferring relatively small amounts of money. Receiving the funds can also be complicated for people in underdeveloped or rural areas, where banks and other formal financial institutions are rare.

Increasingly, these challenges are being met with digital methods for sending remittances using mobile phones, internet platforms, or electronic payment systems. Rather than traditional remittance operations that typically require someone to make an in-person trip to a bank or a money transfer agent, digital payments can be made online or through mobile apps, payment cards, and digital wallets. Digitization creates opportunities for cheaper and more transparent remittance transfers and can broaden financial access. The rise of these technologies was also one important reason that formal remittance transfers remained startlingly resilient during the COVID-19 pandemic, bucking predictions of a massive dropoff and exhibiting only a modest decline of 1.7 percent in the 2019-20 period, before bouncing back to a record $626 billion in 2022. (A large amount of money is also regularly remitted via informal channels; these transfers are very challenging to track.)

At the same time, digitization brings regulatory challenges and may introduce new forms of exclusion. Particularly for countries and diasporas of the Global South, digital remittance pathways intersect with the human element of local informal economies that is crucial for the first- and last-mile outreach—the very beginning and end stages of remittance transfers, where individuals deposit and withdraw cash and where some of the most vexing obstacles can arise. This article reviews recent developments in the digitization of remittances, policy efforts to encourage their spread, and how the transfers interact with humans’ lived experiences, with a particular focus on sub-Saharan Africa.

Can Fintech Help Reduce Remittance Costs?

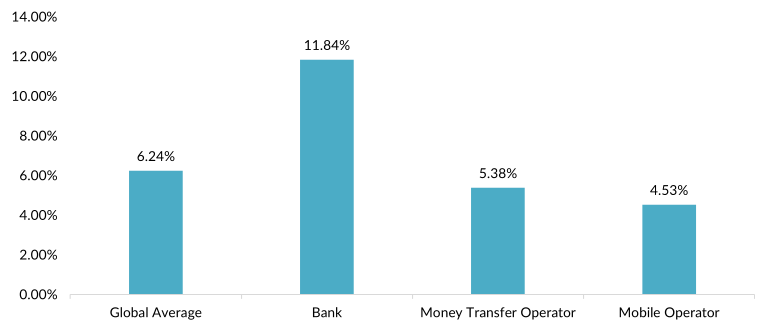

Digital remitting may bring significant reductions in costs, which tend to be highest in the poorest regions of the world. In 2022, the average cost of sending $200 in remittances was above 6 percent, which is double the target the United Nations Sustainable Development Goals set to reach by 2030. Remittance service providers include banks, money transfer operators (such as Western Union and MoneyGram), and non-bank financial institutions (such as credit unions, post offices, microfinance institutions, and others that provide credit and deposit services). Banks tend to be the costliest formal providers, with fees at about 11.8 percent as of the fourth quarter of 2022, according to the World Bank, followed by money transfer operators (5.4 percent). Mobile money providers—which work with funds sent, stored, and received via mobile phone—were the least costly, at 4.5 percent (see Figure 1). Cash has remained the prevailing payment instrument for most remittance transfers. In addition to reducing the amount of money that makes it to recipients, high transfer costs push some users to send their remittances via the shadowy informal sector (which may involve unlicensed money transfer operators, various sideline services of travel agencies, and foreign currency exchange businesses) or encourage people to physically transport money and other goods by using local traders or bus drivers who often form complex informal cross-border networks.

Figure 1. Average Cost of Sending U.S. $200 in International Remittances, by Provider Type, 2022

Note: Data are as of the fourth quarter of 2022.

Source: World Bank Group, Remittance Prices Worldwide Quarterly Issue 44 (Washington, DC: World Bank Group, 2022), available online.

Pandemic-era lockdowns limited people from physically carrying remittances from one place to another, prompting a significant shift from informal to formal transfer channels, including digital ones. International remittances sent via mobile phone saw a 65 percent increase in 2020. The share of adults in developing economies making or receiving digital payments grew from 35 percent in 2014 to 57 percent in 2021. Remittance flows have also been stimulated by regulatory changes in both sending and receiving countries that make it easier to use digital identification and remote processes to send remittances, and often include increased transaction limits and reduced fees for digital payments.

Figure 2. Shares of Population Reporting Increased Use of Financial Technology amid COVID-19 Pandemic, by Type of Technology and Economy, 2021

Source: Cambridge Center for Alternative Finance (CCAF), World Bank, and World Economic Forum, The Global COVID-19 FinTech Market Rapid Assessment Study (Cambridge, UK: CCAF, World Bank Group, and World Economic Forum, 2020), available online.

Some analysts consider digital money transfer technologies to be more transparent and secure than conventional remittance transfers, because transactions are more easily recorded and identified. They also eliminate the costs of maintaining physical branches and distribution networks. On the other hand, digital remitting requires senders and receivers to have access to a transaction account, which can be a barrier, particularly for those without bank accounts, often including humanitarian migrants.

The expansion in digital payments builds on recent technology-enabled innovations in financial services (fintech). Using advanced analysis and storage technologies, these innovations can produce large volumes of data and automate processes, leading to reduced costs and network economies of scale wherein the value of a product or service to an individual grows as it is used by more people. For example, if a person wants to send money to a friend, a mobile money service is more valuable to them if the friend uses the same platform. This encourages more people to join. At the same time, these network effects can create barriers for new companies unable to gain a critical mass of users. The dominance of a few key digital providers can lead to concentration and allow operational problems to have a cascading effect on the broader financial system, posing challenges to financial stability.

Analysts have noted an emerging modularity of finance with the advent of open-application programming interfaces (which allow different software applications to communicate with each other) and open-banking protocols that promote collaboration among financial institutions and third-party providers. This allows the components to be recombined in innovative ways. For example, payment services can be integrated directly into a messaging app, enabling users to make transactions while talking to their friends. On the other hand, the integration of financial services into non-financial platforms, such as chat apps, raises the risk of security and data privacy breaches. As a result, cyberattacks or fraud may now threaten both financial and non-financial aspects of users' lives.

In many developing economies, growing policy debates surround emerging open finance frameworks, in which financial institutions and non-banks (such as mobile money issuers, telecommunications companies, or utility providers) may exchange consumer data to build on each other’s existing infrastructure. While broadening consumer access, this trend may also route users’ data through more intermediaries and should be accompanied by comprehensive data protection frameworks. Fraud surrounding digital finance is widespread—in 2020, 57 percent of digital finance users in Kenya and 51 percent of those in Nigeria reported being exposed to attempted fraud, according to Innovations for Poverty Action research. Also, remittance services often involve multiple parties with their own pricing structures and costs. Transaction fees can vary widely between providers, as can foreign-exchange margins (the difference between the interbank exchange rate and the rate offered to the customer). These charges and fees may not be clear to customers.

Initiatives to Facilitate Efficient Remittance Transfers

The international community is making it a key priority to lower remittance transfer costs and raise transparency. In addition to the Sustainable Development Goals’ 3-percent target mentioned above, the Bali Fintech Agenda (endorsed by the World Bank and International Monetary Fund) discussed how financial technology could help meet other Sustainable Development Goals in low-income countries where access to financial services is inadequate. While recognizing the potential of fintech for broadening financial access, the Bali framework outlined potential risks entailed in new products and activities. It also made recommendations for national authorities to coordinate across agencies, safeguarding consumers and protecting data privacy, ensuring financial and monetary stability, and improving international coordination. Moreover, the Global Compact for Safe, Orderly, and Regular Migration aims to promote faster, safer, and cheaper remittance transfers by, among other things, encouraging competitive markets. However, in a review of the compact’s progress, the 2022 International Migration Review Forum pointed out that digital remittance channels across countries remain unevenly distributed and gaps persist in infrastructure and inclusion.

Elsewhere, the 2023 progress report for the G20’s Roadmap for Enhancing Cross-Border Payments prioritized payment system interoperability, regulatory frameworks for cross-border payment services that foreground a risk-based approach for small-value remittances, and standardized approaches across different data frameworks for cross-border payments. The report highlighted the need to explore new payment infrastructures such as multilateral payment platforms that enable entities from several jurisdictions to provide cross-border payment services to their customers, potentially cutting out intermediaries such as correspondent banks.

For example, the Pan-African Payment and Settlement System (PAPSS), which launched for commercial use in 2022, is a regional, multicurrency common platform that allows participating financial institutions and companies from multiple African countries to provide cross-border payment services. Working in collaboration with central banks, the budding platform aims to address the challenges of high costs and long processing times of cross-border payments, potentially saving users up to $5 billion per year, according to the African Continental Free Trade Area.

Some policymakers hope new digital technologies will help institutions better conduct customer due diligence. Because remittances are private money transfers involving diverse intermediaries, they pose a risk of money laundering and financial support for terrorism. The intergovernmental Financial Action Task Force (FATF) framework for international remittance standards calls for businesses to be licensed or registered and subjected to anti-money-laundering and know-your-customer rules. FATF has also highlighted the need for a risk-based approach that considers country-based peculiarities and customer profiles, and for identifying areas where divergent rules may cause unnecessary friction.

At the same time, many remittance companies using new technologies can still be constrained by overly limiting compliance regulations. The risk-based approach to remittances involves regulatory and financial institutions implementing procedures proportionate to the level of risk of money laundering, terrorist financing, or other illicit behavior. This includes appropriate know-your-customer measures to verify customers’ identities and transaction monitoring practices that are proportionate to the risk posed by small-value remittances. More work is needed to integrate formal compliance frameworks with money transfer infrastructures on the ground, where informal intermediaries such as local money transfer operators, elders, or village leaders can often provide helpful information about the identities and activities of remittance senders and receivers.

Lessons from Africa’s Embrace of Mobile Money

Despite the digital disruption, the human elements of remittance transfer pathways continue to be important, particularly in the Global South. This can be illustrated by the example of sub-Saharan Africa, the most expensive region for sending remittances, with an average cost of around 7.8 percent as of 2022. Africa also has the highest average cost globally for sending intra-region remittances, at about 13.8 percent. Bank-based remittances in Africa were the most expensive, with fees of nearly 16 percent, while money transfer operators averaged 6.2 percent. Digital options in the region cost around 3 percent less than non-digital ones. Still, demand is high: In 2021, remittance flows to the region grew by 16.4 percent and reached $50 billion.

Figure 3. Average Costs of Sending $200 in Remittances, by Region, 2021-22

Note: Data are as of the second quarter of each year.

Source: Dilip Ratha et al, Migration and Development Brief 37: Remittances Brave Global Headwinds. Special Focus: Climate Migration (Washington, DC: KNOMAD/World Bank Group, 2022), available online.

Increasing the volume of remittances sent to people on the African continent is also limited because non-bank payment service providers and money transfer operators frequently have restricted access to national and regional payment infrastructures, preventing them from having the broadest possible reach in the most efficient manner. Additionally, digital infrastructures and internet connectivity are weak in many rural areas.

Despite these challenges, mobile transfers are becoming increasingly popular. Mobile money services are provided by telecommunications companies rather than formal banks and are accessible by text (SMS technology), without the need for smartphones. They have become central financial systems in many areas where residents are unbanked. Mobile money-enabled international remittances, while still representing less than 3 percent of all remittances globally, grew globally by 28 percent in 2022, to $22 billion. One reason is the increasing availability; as of 2022, 45 mobile money providers offered international remittances across 161 country-to-country corridors. Some traditional transfer operators such as Western Union are also pursuing collaboration with mobile money providers, and partnerships between mobile money companies and banks are similarly on the rise. Last year, around 52 percent of mobile money account holders in sub-Saharan Africa received a remittance payment. Mobile money is also a central tool for sending payments domestically in African countries. The World Bank’s 2021 Global Findex Database found that 57 percent of adults in sub-Saharan Africa sent or received domestic money transfers and the most common way was via mobile money. Including domestic transfers, 1.6 billion registered mobile money accounts in 2022 processed transactions valued at $1.26 trillion, a 22 percent year-on-year growth rate.

For companies, interoperability with other in-country providers—which makes it easier to transfer funds—is still sometimes viewed as a competitive disadvantage. But international remittance corridors are increasingly governed by agreements between mobile money providers. For instance, mobile money-based international remittance transactions are quite widespread in countries of the West African Economic and Monetary Union (Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo) and in 2013 Orange Money launched international remittance services between Côte d’Ivoire, Mali, and Senegal. This process was made easier by the existence of a common currency (the West African CFA franc) and central bank. Equally importantly, money transfer networks have built on strong remittance flows between regional seasonal labor migrants. Malians, in particular, have historically depended on informal remittances, due to low rates of formal banking. The new digital pathways have made a difference—as of 2018, Mali featured among the least expensive remittance corridors in sub-Saharan Africa.

Existing migration-related income flows have thus proven important for growing mobile remittance schemes. Cross-border remittances require service providers to work with each other, although there are different technical templates for doing so. In a bilateral agreement model, service providers connect to each other directly; in an aggregator or hub model, a third party or central entity facilitates interoperability between mobile money operators.

The Important Human Element

Still, physical infrastructures for digital remittances remain incomplete in many areas of the Global South, highlighting the significant role of people in facilitating remittances. This includes agents who convert between physical and electronic money and are often working part-time for little pay. The spread of mobile money increases the need for more agents, who often have precarious employment, at more cash-out points, meaning that digital finance can feed economic informality.

In addition to exchanging cash for e-money, mobile money agents increasingly work with customers to provide last-mile connectivity to a variety of fintech products and services. For instance, mobile money services may also allow customers to build savings accounts, pay utility bills, and even obtain small loans, all outside of a formal financial institution. While this may offer consumers more choices, it also increases risks and uncertainties. Mobile money tends to be used by the very poor and has therefore not emerged as a significant competitor to traditional retail banks in Africa. However, this may change as the use of smartphones spreads on the continent and as mobile money providers seek full banking licenses, highlighting the need for novel regulatory approaches and oversight.

Informal savings groups represent another important type of institution mediating the first- and last-mile distribution of remittances. These groups, in which community members come together to pool their money and save for specific purposes, have been increasingly instrumental in many Africans’ livelihoods. Mobile money, which is a formal type of financial inclusion, mediates payments in these informal social networks, helping people deal with financial needs and emergencies. Such groups tend to have customary rotating credit arrangements and are also popular for mobilizing remittances among the diaspora and migrant communities. Transnational saving-credit groups have flourished especially with the rise of digital technology; messaging platforms such as WhatsApp allow members to participate in rotating savings groups from afar.

Digital Remittances: Part of Complex Systems

New digital technologies thus operate in complex environments, raising both opportunities and challenges. At times, the impacts of technology-empowered finance can be at odds with existing informal remittance practices and encourage greater debt. A study from Ghana, for example, found that digital remittance apps can influence customers to take out more loans, because of their use of credit-scoring algorithms and text message nudges. Rapidly growing fintech initiatives in places such as Kenya and South Africa aim to help manage informal savings groups, but may also expose them to commercial lending and investment models that conflict with their mutual support goals. Fintech platforms do not simply make remittance transfers more formal, but also combine a range of old, new, digital, analog, inanimate, and human-based systems.

Supporting digital transfers, therefore, entails reconciling the technological, cultural, and power differences present in formal and informal remittance operations. Access to new digital infrastructures remains uneven, particularly among rural populations and certain social groups. Many women whose livelihoods depend on remittances nonetheless lack sufficient access to financial services and mobile data. The gender gap in account ownership is pervasive: Women in low- and middle-income countries were 28 percent less likely than men to have a mobile money account as of 2021, due in part to underlying structural inequalities as well as social norms that inhibit access to mobile technology. Some of these disparities might be addressed by the potential of digital payment firms originating in the Global South, which can build on important local socioeconomic and market knowledge but nonetheless often face logistical issues and competition from foreign companies.

As digital finance expands in the Global South, it does so amid a mix of people’s formal and informal financial arrangements. Policymakers and regulators could learn from informal practices such as money-pooling to collaborate with a wide range of local institutions and foster financial inclusion. Migrants and others send remittances in part because of their ties to family and community as well as their sense of identity—a broad web of relationships that is more complex than movement from one place to another. Remittances are often informal and personal, yet are embedded in these complex social and financial ecologies. These systems profoundly affect how users engage with remittance transfers, particularly in the first and last miles—and no less so in the era of digital remittances.

Sources

Ardener, Shirley. 2010. Microcredit, Money Transfers, Women, and the Cameroon Diaspora. Afrika Focus 23 (2): 11–24. Available online.

Ardic, Oya et al. 2022. The Journey So Far: Making Cross-Border Remittances Work for Financial Inclusion. FSI Insights on Policy Implementation No. 43, World Bank Group and Bank for International Settlements, June 2022. Available online.

Blackmon, William, Rafe Mazer, and Shana Warren. 2021. Kenya Consumer Protection in Digital Finance Survey. N.p.: Innovations for Poverty Action (IPA). Available online.

---. 2021. Nigeria Consumer Protection in Digital Finance Survey. N.p.: IPA. Available online.

Cambridge Center for Alternative Finance (CCAF), World Bank, and World Economic Forum. 2020. The Global COVID-19 FinTech Market Rapid Assessment Study. Cambridge, UK: CCAF, World Bank Group, and World Economic Forum. Available online.

Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Washington, DC: World Bank Group. Available online.

Farah, Jean Claude. 2021. Western Union Joins Pledge to Improve 1 Billion Lives through Digital Inclusion. Western Union blog post, October 1, 2021. Available online.

Feyen, Erik H.B., Harish Natarajan, and Matthew Saal. 2023. Fintech and the Future of Finance: Market and Policy Implications. Washington, DC: World Bank Group. Available online.

FinAccess. 2019. 2019 FinAccess Household Survey. Nairobi: Central Bank of Kenya, Kenya National Bureau of Statistics, and Financial Sector Deepening Kenya. Available online.

Financial Action Task Force (FATF). 2021. FATF Annual Report 2020-2021. Paris: FATF. Available online.

Financial Stability Board (FSB). 2022. G20 Roadmap for Enhancing Cross-Border Payments: Consolidated Progress Report for 2022. Basel: FSB. Available online.

Friederici, Nicolas, Michel Wahome, and Mark Graham. 2020. Digital Entrepreneurship in Africa: How a Continent Is Escaping Silicon Valley's Long Shadow. Cambridge, MA: MIT Press.

Guermond, Vincent. 2022. Whose Money? Digital Remittances, Mobile Money and Fintech in Ghana. Journal of Cultural Economy 15 (4): 436-51. Available online.

Heyer, Amrik. 2019. Bridging the Gender Divide: Implications for Kenya’s 21st Century Pathway to Inclusive Growth. Financial Sector Deepening Kenya blog post, October 23, 2019. Available online.

Klapper, Leora and Margaret Miller. 2021. The Impact of COVID-19 on Digital Financial Inclusion. Washington, DC: Global Partnership for Financial Inclusion and World Bank Group. Available online.

Langley, Paul and Daivi Rodima-Taylor. 2022. FinTech in Africa: An Editorial Introduction. Journal of Cultural Economy 15 (4): 387-400.

Medine, David and Ariadne Plaitakis. 2023. Combining Open Finance and Data Protection for Low-Income Consumers. Consultative Group to Assist the Poor technical note, Washington, DC, February 2023. Available online.

Mitha, Aiaza, Faith Biegon, and Peter Zetterli. 2022. Banking in Layers: Five Cases to Illustrate How the Market Structure for Financial Services Is Evolving. Consultative Group to Assist the Poor working paper, Washington, DC, July 2022. Available online.

Nautiyal, Anant et al. 2020. The Many Paths to Mobile Money Interoperability: Selecting the Right Technical Model for Your Market. London: GSM Association. Available online.

Ogbalu III, Mike. 2022. Boosting the AfCFTA: The Role of the Pan-African Payment and Settlement System. In Foresight Africa: Top Priorities for the Continent in 2022, ed. Aloysius Uche Ordu. Washington, DC: Brookings Institution. Available online.

Raithatha, Rishi, Aramé Awanis, Christopher Lowe, Devyn Holliday, and Gianluca Storchi. 2023. The State of the Industry Report on Mobile Money: 2023. London: GSM Association. Available online.

Ratha, Dilip et al. 2022. Migration and Development Brief 37: Remittances Brave Global Headwinds. Special Focus: Climate Migration. Washington, DC: KNOMAD/World Bank Group. Available online.

Rodima-Taylor, Daivi. 2014. Passageways of Cooperation: Mutuality in Post-Socialist Tanzania. Africa 84 (4): 553-75.

---. 2022. Platformizing Ubuntu? FinTech, Inclusion, and Mutual Help in Africa. Journal of Cultural Economy 15 (4): 416-35.

---. 2022. Sending Money Home in Conflict Settings: Revisiting Migrant Remittances. Georgetown Journal of International Affairs 23 (1): 43-51. Available online.

Rodima-Taylor, Daivi and William W. Grimes. 2019. International Remittance Rails as Infrastructures: Embeddedness, Innovation and Financial Access in Developing Economies. Review of International Political Economy 26 (5): 839-62.

Scharwatt, Claire and Chris Williamson. 2015. Mobile Money Crosses Borders: New Remittance Models in West Africa. London: GSM Association. Available online.

Tsingou, Eleni. 2021. Global Remittances and COVID-19: Locked Down but Not Locked Out. Global Perspectives 2 (1): 23663.

UN Network on Migration. N.d. IMRF Progress Declaration. Accessed May 27, 2023. Available online.

World Bank Group. 2022. Remittance Prices Worldwide Quarterly Issue 44. Washington, DC: World Bank Group. Available online.